where's my unemployment tax refund

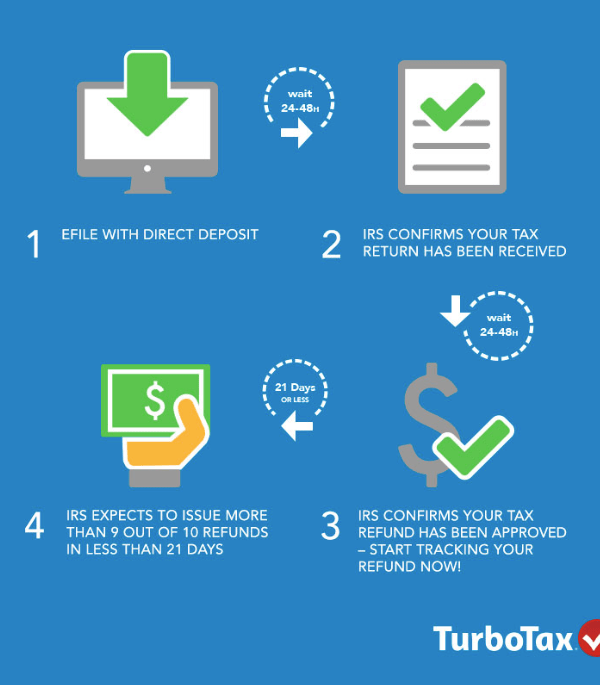

WASHINGTON The Internal Revenue Service announced today it will issue another round of refunds this week to nearly 4 million taxpayers. Refunds by direct deposit will begin July 28 and refunds by paper check will begin July 30.

New York Unemployment Where To Find Your Tax Form For 2020

How long it normally takes to receive a refund.

. The average IRS refund for those who paid too much tax on jobless benefits is 1686. Whether you owe taxes or are awaiting a refund you may check the status of your tax return by. Finally The Checks Start Showing Up.

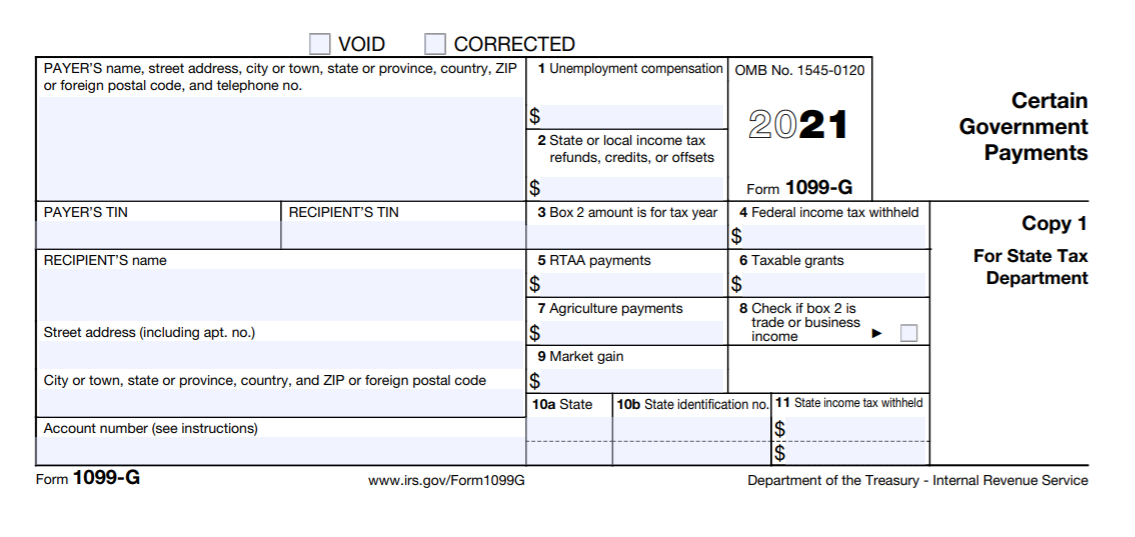

Form 1099G tax information is available for up to five years through UI Online. This is the fourth round of refunds related to the unemployment compensation. If you received unemployment benefits last year and filed your 2020 tax return relatively early you may find a check in your mailbox soon.

How do I check my status for. How much is the IRS Unemployment Tax Refund. If your mailing address is 1234 Main Street the numbers are 1234.

If an adjustment was made to your Form 1099G it will not be available online. If none leave blank. 060121 Some taxpayers whove accessed their transcripts report seeing different tax codes.

Numbers in your mailing address. Using the IRSs Wheres My Refund feature. Your exact refund amount.

This is available under View Tax Records then click the Get Transcript button and choose the federal tax option. If those tools dont provide information on the status of your unemployment tax refund another way to see if the IRS processed your refund is by viewing your tax records. Viewing the details of your IRS account.

Since May the IRS has been. After this you should select the 2020 Account Transcript. The payments will range in size from 200 to 1050 depending on your income filing status and number of dependents.

That law waived taxes on up to 10200 in unemployment insurance benefits for individuals earning less than 150000 a year. IR-2021-151 July 13 2021. Of course youll have to make sure you qualify first.

If you see a 0. Numbers in Mailing Address Up to 6 numbers. IRS Unemployment Tax Refund Update.

Social Security Number 9 numbers no dashes. Check Your 2021 Refund Status. The first batch of these supplemental refunds went to those.

Dor Unemployment Compensation State Taxes

Just Got My Unemployment Tax Refund R Irs

Do I Have To Pay Taxes On My Unemployment Benefits Get It Back

Division Of Unemployment Insurance Federal Income Taxes On Unemployment Insurance Benefits

What Is My State Unemployment Tax Rate 2022 Suta Rates By State

Year End Tax Information Applicants Unemployment Insurance Minnesota

When Can You File Taxes Where Is My Tax Refund Check Money

Questions About The Unemployment Tax Refund R Irs

Ask The I Team How Can Mainers Get A Refund For Taxes Paid On Unemployment Benefits Wgme

America S Jobless Owe Thousands Of Dollars In Taxes On Their Unemployment Benefits The Washington Post

Where Is The Irs Unemployment Tax Refund Tax Refund 2021 Update 300 Unemployment Boost Youtube

/https://static.texastribune.org/media/files/8f76598691a5256e24b6c7cf4a44b760/S%20unemployment%20determination%20TT%2002.jpg)

Texas Unemployment Tips And A Guide For Navigating A Confusing System The Texas Tribune

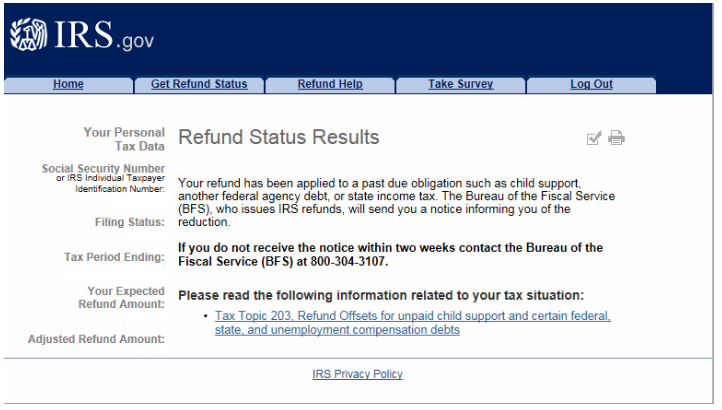

Tax Topic 203 Refund Offset Where S My Refund Tax News Information

The 2022 Tax Season Has Started Tips To Help You File An Accurate Return Internal Revenue Service

Tax Refunds Stimulus Payments Child Credits Could Complicate Filings

How To Receive Your Unemployment Tax Refund As Usa

When Will I Get My Irs Tax Refund Latest Payment Updates And Tax Season Statistics Aving To Invest

Irs Issued 430 000 More Unemployment Tax Refunds What To Know Cnet